Why Is Bank of America Closing Accounts? Here’s What You Need to Know

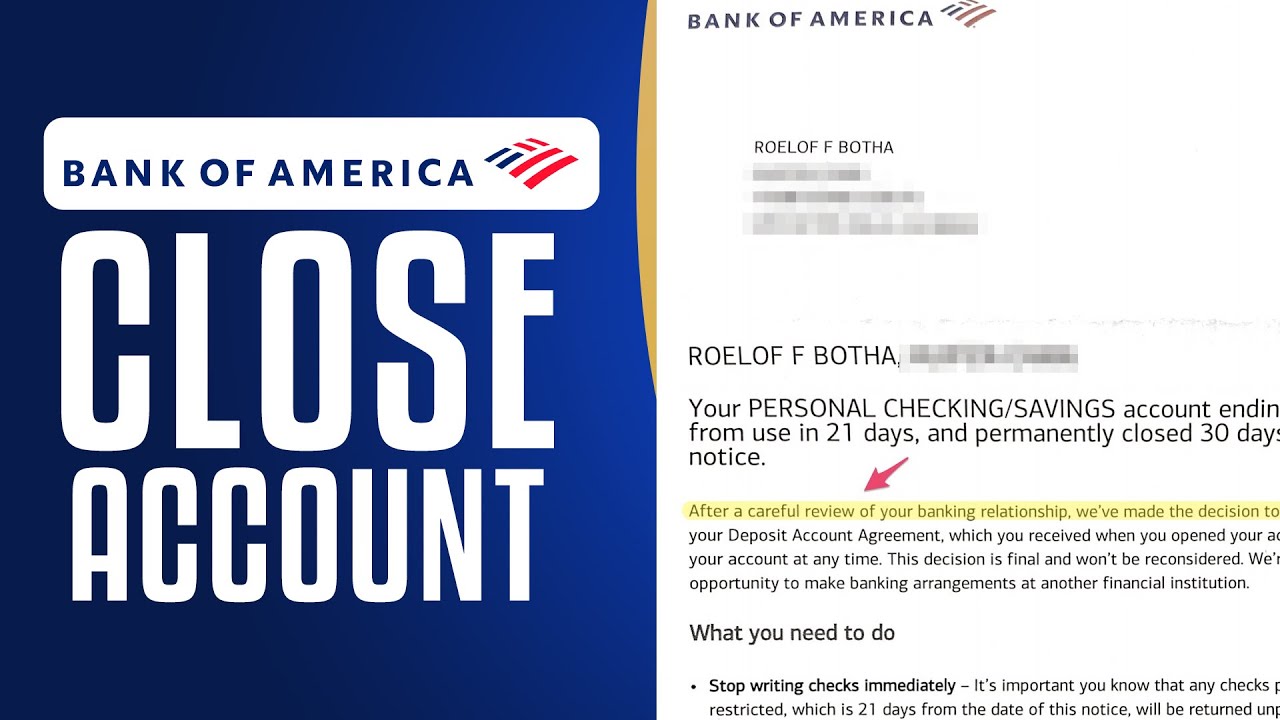

Bank of America customers across the U.S. have reported sudden account closures, sparking frustration and confusion. Many are asking why these closures are happening and how they can protect their accounts from being shut down.

Contents

Reasons Why Bank of America Is Closing Accounts

- Inactivity & Escheatment Laws

- Accounts with no activity for three or more years may be considered abandoned and transferred to the state under escheatment laws.

- Solution: Make regular transactions and keep your account active.

- Regulatory Compliance & Risk Assessment

- Banks are required to monitor accounts for fraudulent or suspicious activity under anti-money laundering laws.

- Accounts flagged for high-risk transactions may be closed as a precaution.

- Account Misuse or Policy Violations

- Customers involved in chargebacks, bounced checks, or excessive overdrafts may see their accounts terminated.

- Business & Political Considerations

- Some reports suggest that accounts associated with certain businesses or political affiliations have been closed. However, Bank of America states that closures are based solely on compliance and financial risk assessments.