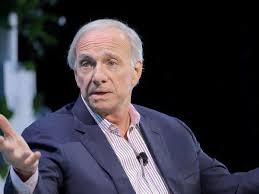

Ray Dalio, the influential billionaire investor and founder of Bridgewater Associates, is once again making headlines with a stark warning about the state of the global economy. Speaking during a recent financial forum, Dalio highlighted the growing tension between the United States and China, rising debt levels, and shifts in global power dynamics as factors that could reshape the international financial system in the coming years.

Dalio has long been regarded as one of the most respected voices in global finance. His books, including Principles: Life and Work, have been bestsellers, and his economic predictions often guide both retail and institutional investors. This time, his message is clear: the world is entering a period of profound transition, and few are prepared for what comes next.

“The U.S. is facing a classic cycle of debt accumulation, internal conflict, and declining international influence,” Dalio said during an event streamed online. “Meanwhile, China continues to rise economically and militarily. When you combine those forces, history suggests the potential for disruption is high.”

He also addressed inflationary pressures and the Federal Reserve’s tightening policies, noting that rising interest rates could create pain for over-leveraged economies. “We are in a period where being cautious, diversified, and global in your thinking is more important than ever,” Dalio advised.

The billionaire’s comments come at a time when many are questioning the resilience of the U.S. economy amid mounting federal debt, regional banking uncertainties, and fragile investor confidence. Dalio also pointed to the weakening U.S. dollar’s role in trade and finance as a sign that the world may gradually move toward a more multipolar currency landscape.

Dalio’s continued emphasis on historical cycles and empirical patterns has made him a go-to figure in uncertain times. His Bridgewater “All Weather” strategy remains a popular model for those seeking to weather volatile markets.

As Ray Dalio steps back from his daily leadership role at Bridgewater, his voice remains influential in public discourse. Investors, policymakers, and the public at large would do well to heed his insights—particularly in a world that appears to be shifting at a pace faster than many expected.